Pet food price comparison is more important than ever. I learned this the hard way when our revenue suddenly plateaued—despite strong products and a solid brand presence. The problem? We had lost control over our margins. It wasn’t until we began systematically monitoring the market that we realized how much price dynamics were putting pressure on our e-commerce performance.

Why pet food prices blew up our calculations

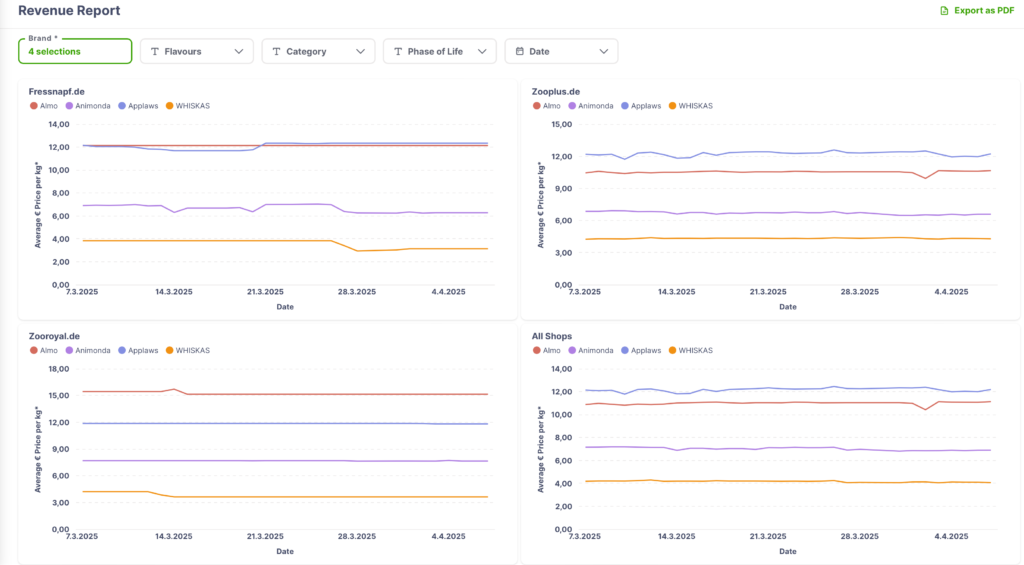

On paper, our product prices were well-calculated—but the market had moved on. Major platforms like Fressnapf, Zooplus, and Zooroyal were offering comparable products at significantly lower prices. And because we didn’t have a structured overview of pet food price comparison across the market, we noticed the shift far too late.

The result: shrinking margins and declining competitiveness. Our prices suddenly seemed too high—not because they were, but because our competitors had quietly pivoted.

What we missed: the rhythm of e-commerce

Online platforms adjust prices daily. Without regular tracking, it’s easy to fall behind. Our competitors were using dynamic pricing, seasonal campaigns, and aggressive discounts. We weren’t. Simply because we lacked the data.

Only after implementing a structured pet food price comparison system could we:

- Detect price changes early

- Analyze competitive behavior

- Adjust our own prices quickly and effectively

How we regained control of our margin

We implemented a structured market price monitoring tool—PetfoodIndex. This tool now gives us daily updates on pet food price comparison from leading online shops, categorized by brand, product type, and format (wet/dry).

- Suddenly, we had clear answers to questions that used to go unanswered:

- Which brands are dominating the premium segment?

- Who’s running promotions—and when?

- How do prices for comparable products evolve over time?

What pricing pressure taught us

We’ve learned that price transparency isn’t just a reporting tool—it’s a strategic asset. With solid data on pet food price comparison, we were able to:

- Position our products more effectively

- Plan discount campaigns with precision

- Back up our pricing strategies in meetings with retailers

It felt like switching on the lights—and regaining room to act.

Why pet food prices must be monitored continuously

The pet market is emotional—but pricing decisions shouldn’t be. If your pet food price comparison isn’t rooted in real-time market data, you’re making blind decisions. In an environment with heavy brand competition, platform pressure, and price-sensitive consumers, you need hard facts. Today, we monitor our core products daily—not weekly, not monthly.

Conclusion: Control begins with clarity

If you suspect your margins are being squeezed in online retail, start by looking at your pet food price comparison—and benchmark against the market. In short, I speak from experience: we only truly gained control of our strategy once we knew, every single day, what was happening out there.

👉 See the report now – with daily tracking of pet food price comparison across 260+ brands

Hear me speak at the Pet Food Congress in Leipzig.